Africa’s Gold Standard Begins Here

Empowering Africa through sovereign wealth, ethical gold monetisation, and institutional excellence

It's Time for Africa To Rise

Reclaiming our wealth. Restoring our gold. Redefining the future of money.

Monetary Sovereignty

Ending dependence on the USD and Euro by creating Africa’s own gold-backed digital currency — AUE — rooted in real value and African wealth.

AUE (Ʌ̲)

AUE is Africa’s own digital currency, fully backed by gold — engineered to become the strongest and most trusted currency in the world.

Monetary Sovereignty

Establishing AUE Gold Banks across Africa — offering full modern banking services powered entirely by real gold and African innovation.

Africa’s Untapped Gold Power

Africa holds approximately 40% of the world’s gold reserves, yet its currencies remain chronically weak, its trade is priced in USD/EUR, and its economic systems are vulnerable to foreign-denominated inflation and policy shocks. Despite producing over 1,400 tonnes of gold per year, African nations monetise only a fraction of this value internally. Most gold is exported raw, refined offshore (mainly in Switzerland, Dubai, and India), and re-imported in the form of financial instruments or jewellery — a value loss exceeding $60–80 billion annually, according to UNCTAD and Afreximbank estimates.

The Result

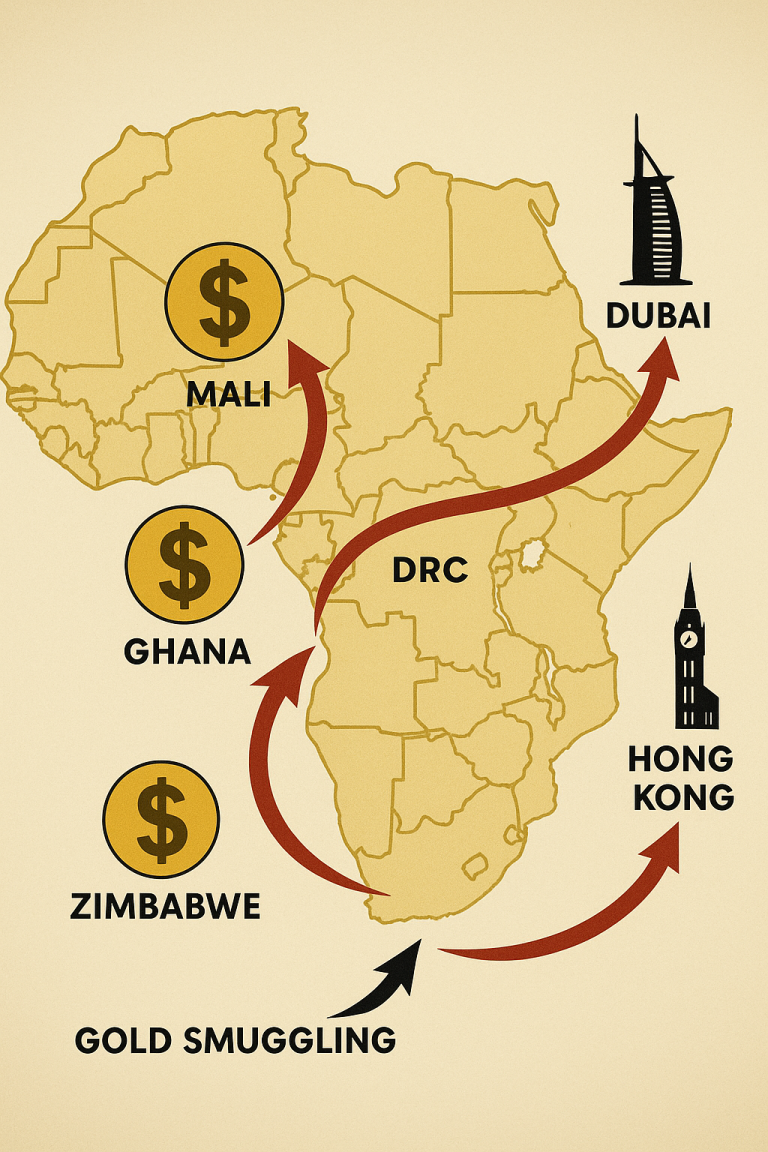

- Massive leakage of monetary value via smuggling, under-invoicing, and illicit trade routes.

- Weak and volatile domestic currencies, despite high resource wealth.

- Dependence on the USD and EUR for international trade and reserves, exposing economies to foreign interest rate cycles, sanctions, and inflation.

- Underdevelopment in gold-producing regions, where mining communities remain impoverished despite the immense value extracted from their soil.

This situation represents a systemic imbalance – where Africa provides the hard asset (gold) but derives no monetary sovereignty from it. Gold is monetised in London and Zurich and in Africa. The AUE project seeks to correct this by transforming in-continent gold into a regulated, sovereign African currency that can serve as a store of value, medium of exchange, and unit of account.

The AUE Solution: Africa’s Gold-Backed Digital Currency

What AUE Is and How It Works:

AUE is a fully gold-backed digital currency, issued only against verified physical bullion held in secure, in-continent vaults. Au is the scientific code for gold, and E represents its digital nature. Each unit of AUE is:

- 1 AUE (Ʌ̲) = 1 gram of 99.99% pure gold, with fractional units (milli-AUE or mAUE) for ease of use in retail and micro-transactions.

- Issued by a sovereign central Reserve Bank, with strict issuance controls, daily reconciliations, and public audit trails.

- Governed by a multilateral treaty framework ratified by AU member states, ensuring full legal backing, enforceability, and sovereignty protection.

AUE is not a speculative crypto token or a derivative — it is a real digital currency, anchored to physical reserves held underground in Africa, governed by an African institution, and protected by sovereign guarantees.

Institutional and Legal Architecture of the AUE System

The African Union Economic System is anchored in a robust, continent-wide architecture designed to uphold monetary sovereignty, ethical finance, and institutional integrity. Each image below represents a core pillar of this system — from LBMA-standard refineries and underground vaults securing gold reserves, to a vast network of Gold Bank branches offering inclusive financial services. At the heart of operations stands the Central Reserve Bank in Cape Town, overseeing issuance and regulatory functions. This entire ecosystem is fortified by sovereign cloud infrastructure and biometric security, ensuring digital resilience. Oversight is entrusted to the African Union Committee, safeguarding transparency and continental trust. Together, these components form the backbone of Africa’s gold-backed currency system — built for stability, scalability, and global relevance.

AUE Gold Refineries

Underground Vaults

AUE Gold Banks

HQ & AUE Reserve Bank

Digital Ecosystem

AU Commission

The Heart of Africa’s Sovereign Wealth

- Sovereign land allocations for refinery and vault complexes, designated as AU-protected territories.

- Legal export bans on raw gold, mandating that all monetisable production be processed through the AUE ecosystem.

- Parliamentary ratification embedding AUE compliance within national legal frameworks.

- Tax and duty exemptions for all AUE infrastructure and related inputs.

- Diplomatic and legal immunities for personnel and reserve assets, protecting them from seizure or external interference.

This framework guarantees political continuity, enforceability, and alignment with the African Union’s Agenda 2063.

All components are interdependent. The operational integrity of the AUE currency depends on the simultaneous deployment of its monetary, physical, banking, and digital systems. Refineries cannot function without the Reserve Bank and Gold Bank infrastructure; similarly, the Reserve Bank cannot issue currency unless physical reserves are already refined, vaulted, and fully audited within the treaty framework.

AUE Gold Backed Currency

A true currency backed by Africa's most valuable resource

Why a Gold-Backed Continental Currency Is Imperative:

- Capture In-Continent Value: A gold-backed digital currency denominated in physical bullion secures value retention within Africa, preventing offshore leakage and maximising economic benefit.

- Enhance Monetary Sovereignty: By creating a currency backed by tangible assets under continental control, African states can reduce reliance on foreign currencies and strengthen fiscal independence.

- Stabilise Currencies: The gold-backed currency introduces price stability and inflation resistance, promoting confidence among citizens, investors, and international partners.

- Reduce Smuggling and Illicit Trade: Transparent, traceable gold monetisation through regulated systems minimises smuggling incentives and promotes formalisation of the gold supply chain.

- Promote Continental Integration: A unified currency backed by Africa’s gold resources fosters intra-African trade, investment, and economic cohesion under the African Union’s broader integration agenda.

- Leverage Africa’s Gold Wealth for Development: Monetising gold domestically enables governments to finance infrastructure, social programs, and economic diversification without excessive borrowing or currency devaluation.

Documented Background & Rationale:

- According to the World Gold Council, Africa contributes approximately 20% of global gold production, yet the continent captures less than 10% of the total gold value due to offshore refining and trading.

- The African Development Bank reports that currency volatility and inflation remain key constraints to economic growth, particularly in resource-rich countries.

- The African Union’s Agenda 2063 emphasises the need for regional economic integration and resource-based industrialisation, both of which require monetary tools that reflect Africa’s unique assets and needs.

- Empirical studies show that gold-backed currencies historically deliver superior inflation control and economic stability compared to fiat currencies vulnerable to over-issuance and speculative attacks.

The AUE project directly addresses these challenges by creating a structurally integrated system where gold production, refining, monetisation, and banking are continentally governed, transparent, and sustainable. This creates an unprecedented opportunity to transform Africa’s economic landscape by aligning monetary policy with tangible asset backing and sovereign control.